ALPHA Partners

Network Driven Growth Capital

We partner with Early-Stage VCs to double down in their leading companies. Small, specialist VCs are the first funders of 80% of unicorns and tech IPOs, but 90% of the time, these first funders lack the capital to follow on in their growth stage winners. Alpha is purpose built to solve this capital gap for Early-Stage VCs. As a result, Alpha invests in top-tier growth equity rounds led by the world’s best investors.

How we increase returns for Early-Stage VCs

Alpha Partners enables Early-Stage Venture Capitalists to capitalize on their later stage winners.

For Limited Partners

Alpha’s Growth Equity Model targets Venture returns at lower risk and duration.

Portfolio

Coupang is a South Korea’s largest online retailer. Coupang offers an e-commerce platform that is powered by innovative technology and operations.

Coursera is an online education company that serves millions of registered learners by partnering with 140 of the world’s best universities and education institutions.

Vroom is a New York-based online platform that enables users to buy, sell and trade-in used cars in the United States.

Cloud Technology Partners helps companies plan, design and build cloud solutions for their applications and infrastructures.

Apollo.io is a data intelligence and sales engagement platform through which sales professionals can find the right buyers at the right companies at the right time.

Brave Health is a virtual mental health provider dedicated to helping people thrive by engaging them in high-quality, affordable, and easily accessible mental health care.

Doctor on Demand is a fast, easy way to see an urgent care doctor or psychologist on your computer, tablet, or phone—from the comfort of your own home.

Gecko Robotics designs and develops robots to automate industrial inspection and repair where existing processes are dangerous and inefficient.

Lime provides an accessible and affordable micro-mobility solution to improve the way people experience first and last mile transportation.

Thirty Madison is building the premier healthcare company for people with chronic health issues. Through their novel approach to care delivery, powered by their proprietary platform and brands built around specific chronic conditions, they combine the best of specialist-level healthcare with the convenience of telemedicine.

ZenBusiness helps people take the leap into small business ownership by providing everything they need to turn their idea into a money-making business.

Shield AI is a cutting-edge technology company that specializes in developing artificial intelligence systems for autonomous operations in complex and dynamic environments, with a focus on enhancing the capabilities of military and defense forces.

Second Front Systems is a public benefit, venture-backed software company that equips defense and national security professionals for long-term, continuous competition for access to emerging technologies.

Portfolio

Brave Health is a virtual mental health provider dedicated to helping people thrive by engaging them in high-quality, affordable, and easily accessible mental health care.

Coursera is an online education company that serves millions of registered learners by partnering with 140 of the world’s best universities and education institutions.

Doctor on Demand is a fast, easy way to see an urgent care doctor or psychologist on your computer, tablet, or phone – from the comfort of your own home.

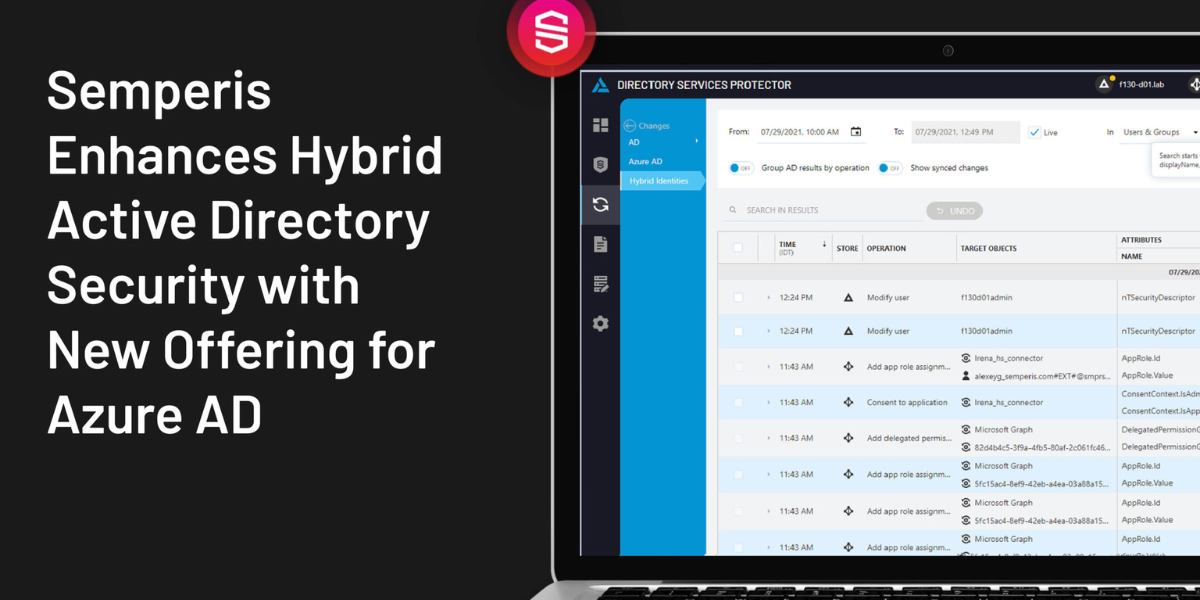

Active Directory is exploited in 90% of cyberattacks. Protect your core identity system. Expose blind spots. Minimize downtime. Stop attackers in their tracks.

Team

Steve Brotman

Founder and Managing Partner

Sam Silvershein

Vice President

Michela Bracich

Investor Relations and Operations Manager

Michelle Modest

Investor

Michael Staton

Venture Partner

Oliver Henry

Investor

Brian Smiga

Partner

Mike Ryan

Venture Partner

Steve Gentili

Vice President

Zoe van den Bol

Investor

Danny Edman

Investor

Advisors

Team

Steve Brotman

Founder and Managing Partner

Brian Smiga

Partner

Sean O’Brien

Chief Financial Officer

Sam Silvershein

Vice President

Mike Ryan

Venture Partner

Abubakr “Mali” Malida

Director of Investor Relations

Michela Bracich

Investor Relations and Operations Manager

Steve Gentili

Vice President

Dan Stolar

Venture Partner

Michelle Modest

Associate

Zoe van den Bol

Investor

Matt Krna

Venture Partner